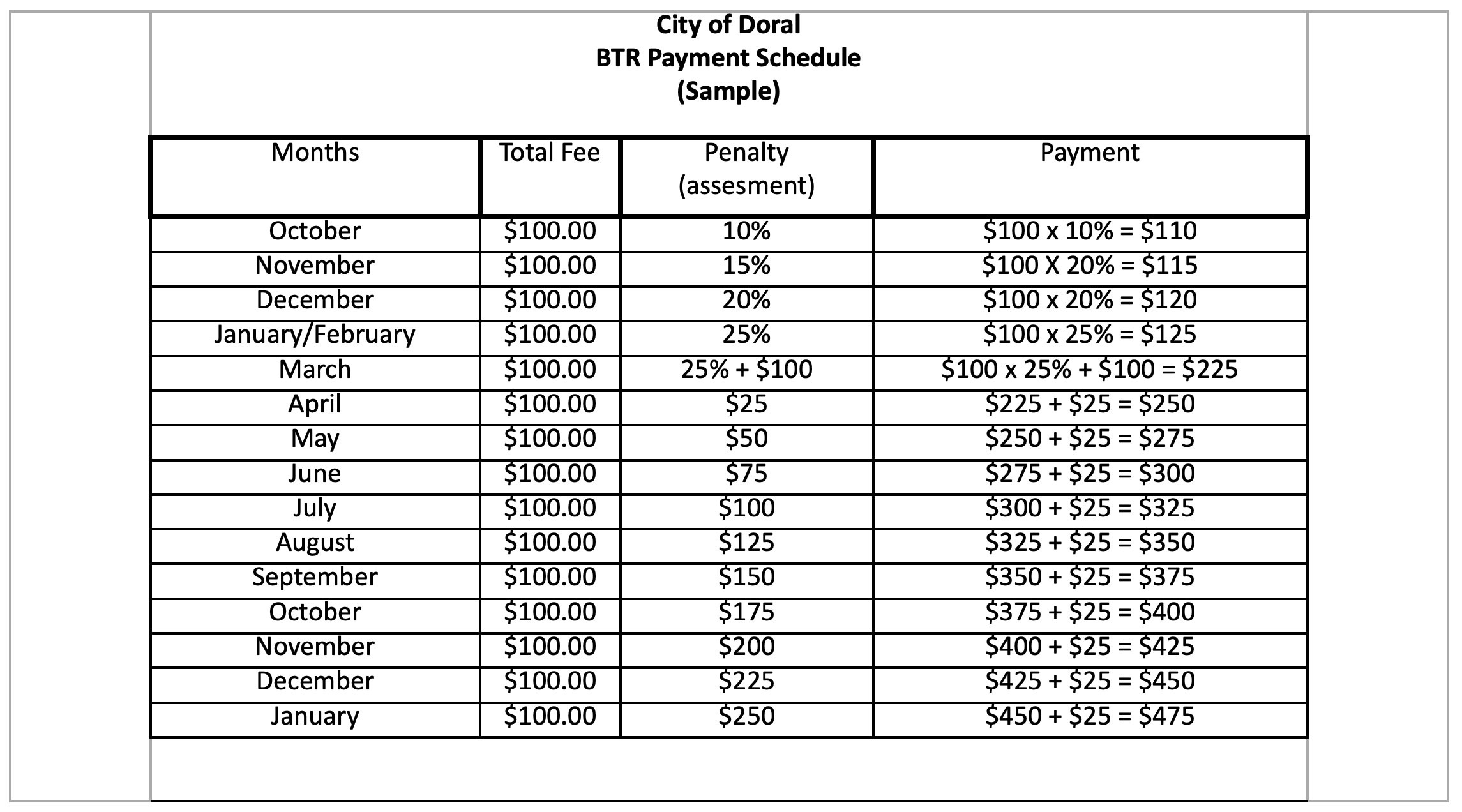

BTR Payment Schedule Sample

The BTR renewal notice is a courtesy reminder to renew before the expiration date to avoid penalties. Per City of Doral Ordinance No. 2013-24.

Pursuant to section 41-79 - Penalty for late payment:

*Any person failing to timely apply for the annual renewal of a business tax under this article may be issued a tax receipt only upon payment of a delinquency penalty of ten percent for the month of October or portion thereof and an additional five percent for each month of delinquency thereafter or portion thereof until paid. Payments must be received by the city prior to the first day of each penalty month to avoid additional penalties; however, the total delinquency penalty shall not exceed 25 percent of the business tax amount.

Pursuant to F.S. § 205.053 the city will assess an additional penalty of $100.00 if the business tax remains unpaid for 150 days after the initial notice of tax due. For each month after 150 days, an additional $25.00 dollar per month shall be assessed up to a maximum of $250.00*